Officials say West Virginia's jobless benefits fund could be OK for 7 more years  Officials believe West Virginia can go at least seven years before depleting the trust fund that supplies jobless benefits -- but that's only if the state's employment situation doesn't get worse.

Officials believe West Virginia can go at least seven years before depleting the trust fund that supplies jobless benefits -- but that's only if the state's employment situation doesn't get worse.

The closer the state gets to the national unemployment rate of 6.7 percent, the greater the threat of a more immediate insolvency, said Workforce West Virginia Executive Director Ron Radcliff.

The state rate, adjusted for seasonal hiring trends, was 4.6 percent last month. Only eight states reported less unemployment.

Radcliff is heading a task force assigned by Gov. Joe Manchin to find ways to keep the trust fund solvent. Repeated warnings about the fund's future helped spur Manchin, while the deepening economic recession has added a sense of urgency.

"It's better to look at it before you start into the problem areas, than when you're in the middle of one," Radcliff said last week.

Since the start of the recession last December, the national economy has shed nearly 2 million jobs. Analysts predict 3 million more will be lost between now and the spring of 2010. The recession is shaping up to be the longest since the Great Depression.

Nearly 40 percent of states don't have enough in their trust funds to last 12 months, the minimum recommended reserve. West Virginia had a $250.7 million balance last month, more than either neighboring Ohio and Kentucky despite their larger workforce populations.

West Virginia also appears to be drawing from its unemployment compensation trust fund more slowly than a majority of other states, according to a recent analysis by the National Conference of State Legislatures.

The trust fund shrank by 4.1 percent between November and Dec. 11, the analysis found, while 26 states saw their balances decline at a faster rate. South Carolina led the states, paying out nearly 58 percent of its remaining balance during those 11 days. New York and Ohio followed, with the latter expecting to have to borrow federal funds next month or February to cover benefits.

One state showed trust fund growth: Michigan, but only because it had already run out of money and has taken $612.8 million in federal loans. Its fund is pressured by the nation's worst unemployment rate, of 9.6 percent.

But a red flag for West Virginia's fund is its average high cost multiple. The U.S. Labor Department measures the fund balance as a percentage of total wages. It then calculates the ratio of benefits paid to total wages during the three costliest years for the fund during at least the last two decades. The multiple reflects the first figure divided by the second.

West Virginia's multiple for the third quarter of 2008 was 0.45. Thirty-one states has a higher, or better, multiple. Those states with lower multiples include nearly all those in danger of exhausting their trust funds within the next 12 months, and the two who have done so already: Michigan and Indiana.

Radcliff disagrees with the Labor Department calculation. He said it wrongly includes high cost rate ratios from the 1980s, when West Virginia's fund became insolvent.

Double-digit unemployment -- the rate soared as high as 18.2 percent in early 1983 -- plus flat trust fund revenues forced the state to borrow $308 million from the federal government to provide the needed jobless benefits. The state later sold bonds to repay those loans, levying a tax on both employers and workers to cover the bonds.

Memories of that crisis continue to haunt West Virginia's program, and also helped prompt the task force review.

"If you take away that early 80s period, our solvency has remained fairly stable," Radcliff said.

But a 2005 legislative audit, which warned of a looming insolvency, found that the multiple should include such historical rough patches. It cites a guide to such programs relied upon by the U.S. House Committee on Ways and Means.

"States with average high cost multiples of at least 1.0 have reserves that could withstand a recession as bad as the worst one they have experienced previously," the audit said, quoting from the congressional 'Greenbook.' "States with average high cost multiples below 1.0 may face greater risk of insolvency during recessions."

[ForexGen Introducing Brokers]

Introducing Brokers may be individuals or institutions who gain their income from the commissions and/or rebates by introducing customers to ForexGen trading.

WHAT are the advantages of being an INTRODUCING BROKERS with ForexGen?

* Providing the most huge income sharing plan

* Providing several ways for our IB's to charge commission.

* ForexGen IB can also charge commission for each lot the traders execute.

* Moreover, ForexGen IB is able to increase the spread for all or certain clients and have ForexGen Investments rebate the difference.

In case the IB does not increase the spread or charge their clients a commission, ForexGen rebate the IB a minor predefined amount for every client's executed lot.

Commission is paid out every month.

Individualized service

[ForexGen] offers our IB's individualized service created according to the individual needs and specified business situation for each IB.

Our Introducing Broker program provides a highly organized program for individualized services and organizations in order to introduce their clients to the online foreign currency exchange market, moreover they will enjoy the benefits of being a part of the ForexGen family.

ForexGen offers 1 pip spread on 10 pairs with high trading techniques that make ForexGen

incomparable to any other rival.

Health Relative For WVa. Jobless Benefits Fund

Monday, December 29, 2008

Posted by Broker.Forex at 4:19 PM 1 comments

Forex Traders Remain Net Long the US Dollar vs Japanese Yen

Sunday, December 28, 2008

USD/JPY Ratio: 1.22

Trading Forecast: Bearish USDJPY – The ratio of long to short positions in the USDJPY stands at 1.22 as nearly 55% of traders are long. Yesterday, the ratio was at 1.36 as 58% of open positions were long. In detail, long positions are 2.5% higher than yesterday and 21.6% weaker since last week.

USDJPY – The ratio of long to short positions in the USDJPY stands at 1.22 as nearly 55% of traders are long. Yesterday, the ratio was at 1.36 as 58% of open positions were long. In detail, long positions are 2.5% higher than yesterday and 21.6% weaker since last week.

Short positions are 14.7% higher than yesterday and 42.8% weaker since last week. Open interest is 7.6% stronger than yesterday and 46.8% below its monthly average. The SSI is a contrarian indicator and signals more USDJPY losses.

[ForexGen Scalping Enabled Account]

Trade and scalp the market ForexGen has the pleasure to announce the availability of both Dealing Desk and No Dealing Desk Platforms. No Dealing option provide traders with direct access to the best bid/ask prices through multiple bank access. No re-quotes & No dealer confirmation is the main characteristic of the no dealing option made specifically for “scalpers” and active FX professionals. Absolute freedom to trade during news and economic events. The no dealing desk option allows traders to place entry orders inside the spread! Unlike competing FX firms, [ForexGen] offers traders all the advantage of a “no dealing desk” option.

Advantages of No Dealing Desk Option

*Trade the news without intervention or restrictions

*Although spreads may vary in volatile market conditions, they are tried to be kept within the usually limits.

*Place scalping orders without intervention or restrictions.

*A client-friendly trading environment, No re-quotes.

*Ability to place orders inside the spread

*Competing rates from multiple banks

*Spreads are variable and can move sharply

*Ideal for active or professional FX traders

For more information about our current and future promotions, kindly visit this page often or contact one of our customers support agents at promotions@forexgen.com, or you can [chat] with our representatives, you can also[request a call back]from one of our agents by sending us your contact number and the best time we can reach you.

Posted by Broker.Forex at 12:50 PM 0 comments

Labels: Scalping Enabled Account, USDJPY

Currencies Come in Pairs

Thursday, December 25, 2008

To make matters easier, forex markets refer to trading currencies by pairs, with names that combine the two different currencies being traded, or “exchanged,” against each other.

To make matters easier, forex markets refer to trading currencies by pairs, with names that combine the two different currencies being traded, or “exchanged,” against each other.

Additionally, forex markets have given most currency pairs nicknames or abbreviations, which reference the pair and not necessarily the individual currencies involved.

[ForexGen Money Manager] An individual who is responsible for the entire financial portfolio of another individual or another entity. A money manager receives payment in exchange for choosing and monitoring appropriate investments for the client.

An individual who is responsible for the entire financial portfolio of another individual or another entity. A money manager receives payment in exchange for choosing and monitoring appropriate investments for the client.

Benefits of being a Money Manager with [ForexGen]:

* Providing three different commission sources.

* Weekly commission plan.

* Easy & fast commission withdrawals.

* Fixed percentage of the profits.

* P = k * D “P=Profit, k=Variable Parameter, D=Deposits”

The money manager gets a fixed percentage of the profit previously agreed upon with the client for managing the client funds as a bonus feature.

The most competitive trading conditions:

* 2 pips spread on six currency pairs.

* Providing online trading services without maintenance margin, margin call and no automatic closing of positions below the initial margin on weekdays for accounts with initial equity of up to $1 million US. The margin level have to be recognized Fridays at 23:00 CET and before public holidays.

* Leverages up to 1:200 for accounts up to $1 million US.

* Liquidity and 24/5 availability are the characteristic factors of the Forex market compared with other financial markets.

Posted by Broker.Forex at 2:52 PM 0 comments

Labels: currencies, ForexGen Money Manager

Short-Term Forex Technical Outlook: GBP/JPY

Wednesday, December 24, 2008

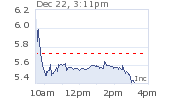

Risk aversion paired with narrowing demands for carry trades pushed the GBPJPY to its lowest level in over a decade, and the downward trend is likely to hold as we head into the New Year as investors continue to curb their appetite for risk.

Currency Pair: GBP/JPY

Chart: 60 Min Charts

Short-Term Bias: Bearish

Analysis  Risk aversion paired with narrowing demands for carry trades pushed the GBPJPY to its lowest level in over a decade, and the downward trend is likely to hold as we head into the New Year as investors continue to curb their appetite for risk. Increased selling pressures dragged the pair to a fresh low for the month as it slipped to 132.01 on 12/22, signaling that traders remain bearish against the pound-yen. As the pair continues to test for support, I anticipate the pair to move lower over the near-term, and we may see the GBPJPY work its way down towards the 4/10/95 low of 127.03 over the coming weeks.

Risk aversion paired with narrowing demands for carry trades pushed the GBPJPY to its lowest level in over a decade, and the downward trend is likely to hold as we head into the New Year as investors continue to curb their appetite for risk. Increased selling pressures dragged the pair to a fresh low for the month as it slipped to 132.01 on 12/22, signaling that traders remain bearish against the pound-yen. As the pair continues to test for support, I anticipate the pair to move lower over the near-term, and we may see the GBPJPY work its way down towards the 4/10/95 low of 127.03 over the coming weeks.

However, as markets remain thin throughout the end of this year, trading under these circumstances are highly unfavorable, and investors may wish to wait until the New Year to resume trading.

[ForexGen Demo Accounts Contest]

Win Cash Prizes

[ForexGen] has the pleasure to announce the launching of the Demo Account contest on the first of every month.

Interested clients who wish to participate in this event shall send an e-mail request on demo.contest@forexgen.com including the following information:

- Full name:

- Phone number

Also provide us with the following identification document:

" Certified copy of the information pages of account holder current valid passport or government issued photo ID"

For more information about our current and future promotions, kindly contact one of our customers support agents at promotions@forexgen.com

Posted by Broker.Forex at 2:02 PM 0 comments

Labels: Forex Technical, GBP JPY

Dow Falls For 5th Straight Session on Grim Data

Tuesday, December 23, 2008

Wall Street declines as investors sift through more data showing an anemic economy  Wall Street pulled back again Tuesday in muted trading ahead of the holiday, as another round of reports showed further deterioration in the housing market and broader economy.

Wall Street pulled back again Tuesday in muted trading ahead of the holiday, as another round of reports showed further deterioration in the housing market and broader economy.

The Dow Jones industrial average finished lower for the fifth straight day, falling 100 points.

Tuesday's gloomy data was hardly surprising to jaded investors. And trading volume has been light this week, which tends to skew the market's movements; many traders are on vacation for Christmas, and the market will close early, at 1 p.m. EST, on Wednesday.

"It is a very quiet news week, and much of it has already been priced into the market," said Ryan Larson, head of equity trading at Voyageur Asset Management.

The reports offered Wall Street no reason to be upbeat, however, and the concern remains that the economy will keep weakening well into the new year. That anxiety is sapping the hope for a year-end rally in the Dow, which is has fallen 36.5 percent since 2008 began.

The Commerce Department reiterated Tuesday that third-quarter gross domestic product, a measure of the economy that tallies the value of goods and services, fell at an annual rate of 0.5 percent.

The government also said sales of new homes fell in November to the slowest pace in nearly 18 years, while prices of new homes dropped by the biggest amount in eight months.

Sales of existing homes keep dropping as well. The National Association of Realtors said existing home sales fell 8.6 percent to an annual rate of 4.49 million in November from a downwardly revised pace of 4.91 million in October. That was more than analysts expected.

The Dow Jones industrial average shed 100.28, or 1.18 percent, to 8,419.49. The Dow is well off the multiyear lows it tumbled to in mid-November, but it is still down more than 400 points, or 4.6 percent, so far for the month of December. Typically, December is the one of the best months for the stock market.

Broader indexes also declined on Tuesday. The Standard & Poor's 500 index fell 8.47, or 0.97 percent, to 863.16. The Nasdaq composite index fell 10.81, or 0.71 percent, to 1,521.54. The Russell 2000 index of smaller companies fell 6.43, or 1.35 percent, to 468.64.

Declining issues led advancers by 3 to 2 on the New York Stock Exchange, where consolidated volume came to 3.63 billion shares, down from 4.31 billion shares on Monday.

Government bond prices were narrowly mixed. The yield on the benchmark 10-year Treasury note, which moves opposite its price, was flat at 2.18 percent. The yield on the three-month T-bill, considered one of the safest investments, was unchanged at 0.02 percent from late Monday.

News from corporate America on Tuesday brought little cheer.

Greeting-card company American Greetings Corp. said it swung to a third-quarter loss, hurt by hefty charges and a decline in sales. Shares fell $3.42, or 35 percent, to $6.40.

And the shape of the financial industry continued to shift, as two more companies got government funding.

Credit card lender American Express Co. and commercial financial firm CIT Group Inc. said Tuesday they each received preliminary approval to obtain billions in funding from the government's $700 billion bank investment program.

American Express fell 46 cents, or 2.5 percent, to $17.96, and CIT Group rose 8 cents to $4.26.

Shareholders approved two acquisitions that were forced by banks' massive credit losses.

PNC Financial Services Group Inc. and National City Corp. shareholders approved PNC's acquisition of the Cleveland-based bank, and Wells Fargo & Co. and Wachovia Corp. shareholders approved Wells Fargo's $11.8 billion purchase of the Charlotte, N.C.-based bank.

Shares of Pittsburgh-based PNC rose 33 cents to $43.01, and National City shares edged up 4 cents, or 2.5 percent, to $1.65 on its last day of trading.

Shares of San Francisco-based Wells Fargo fell 43 cents to $26.99, and Wachovia shares fell 15 cents to $5.30.

The dollar was mixed against other major currencies, while gold prices fell.

Oil prices fell on concerns that energy demand is evaporating in the face of a severe global economic slowdown. Light, sweet crude fell 93 cents to settle at $38.98 a barrel on the New York Mercantile Exchange, after dipping below $38 earlier in the day.

The plunge in energy prices has brought little comfort to stock investors. The downturn should give consumers a break when they heat their homes and fill their cars' tanks, but it is a glaring sign of the grim economic outlook and the shattered financial industry.

ForexGen offers three types of business partnerships:

ForexGen offers three types of business partnerships:*Introducing Broker

*White label

*Money Manager

ForexGen Introducing Brokers, White Label and Money Manager holders are recognized as a strategic business partners. The main focus of our service is to satisfy our partner's needs in order to deal with a qualified service and gain a huge income sharing plan.

[ForexGen] provide appropriate services satisfying the needs of all business partner's specified situation and requirements.

Posted by Broker.Forex at 5:19 PM 0 comments

Labels: Dow Falls, forexgen Partnership

Steelcase Sees 4th-Quarter Loss in Tough Economy

Monday, December 22, 2008

Steelcase predicts 4th-quarter loss, weaker-than-expected sales in tough economy

Steelcase expects a fourth-quarter loss between 4 cents and a loss of 10 cents per share, including $9 million in restructuring costs, and revenue within a range of $650 million to $700 million.

Analysts polled by Thomson Reuters expect an 11 cent profit and sales of $747 million.

"We believe that the slowing of the global economy and related uncertainty will lead to significant reduction in industry demand for the next several quarters," said David C. Sylvester, chief financial officer.

Steelcase anticipates commodity costs to rise about $5 million to $10 million in the fourth quarter compared with the prior year.

Separately, Steelcase posted a drop in third-quarter profits because of a big charge and lower sales as ongoing weakness in the economy crimped demand.

Steelcase shares rose 16 cents, or 2.7 percent, to $5.89 in premarket trading.

[ForexGen Live Account]

The live/real account is provided to those clients who may have some experience in the online trading.

[Opening an Account Online]

The quickest, easiest and secure way to open a ForexGen trading account is online.

Complete and submit your application online in just a few minutes.

ForexGen.com is an online trading service provider supplying a unique and individualized service to Forex traders worldwide. We are dedicated to absolutely provide the best online trading services in the Forex market.

ForexGen provides a unique online trading experience based on our intelligent online Forex trading package, the ForexGen Trading Station, including the best online trading system.

Posted by Broker.Forex at 12:21 PM 0 comments

Fed Rate Cut Has limited Impact on Consumers

Thursday, December 18, 2008

The Federal Reserve may have cut its key short-term interest rate to the lowest level on record, but that doesn't mean credit will be any easier to get.

The Federal Reserve may have cut its key short-term interest rate to the lowest level on record, but that doesn't mean credit will be any easier to get.

The move to lower the fed funds target rate to a range between 0% and 0.25%marked the tenth time the Fed has cut rates in the past 15 months in an attempt to jumpstart the economy.

Generally, the Fed lowers rates when it is concerned about the economy slowing because consumers tend to spend more when the cost of borrowing is cheap. But economists say the problem for consumers and businesses right now is not the cost of borrowing, but the availability of credit.

"Consumers might see lower rates but it's still hard to get a loan," said Gus Faucher, director of macroeconomics at Moody's Economy.com. "Banks are taking big hits, and they're still trying to preserve capital. So they'll only make loans if you're a good credit risk."

How it works

The federal funds rate is an overnight lending rate that is used as a benchmark to determine the price of a variety of loans, including credit cards, home equity loans, lines of credit and car loans.

Most types of consumer loans are pegged to the prime rate, which is directly influenced by the federal funds rate. Typically, the prime rate is 3 percentage points higher than the federal funds rate. It was 4% before Tuesday's rate cut; just after the decision, several banks announced they were lowering their prime rate to 3.25%.

In turn, all credit cards with variable interest rates will automatically reset to reflect the lower rate. That is good news for card holders, but expect issuers to counter it by setting rate floors in order to preserve their margins, as well as scaling back consumer credit lines and closing old accounts.

"Banks are trying to mitigate losses," said Robert McKinley, CEO of CardWeb.com, a credit card tracking Web site.

"New credit is going to be a problem," McKinley added. "If you have shaky credit you're going to be very challenged to find money...even people with good credit are going to find it's not as easy to get credit," he said.

And the same goes for consumers shopping for home equity lines of credit. "Lenders are not jumping up and down to be a second lien holder at a time when home prices are falling and foreclosures are rising," said Greg McBride, senior financial analyst

Those in the market for a new car will certainly find deals, but that's mostly thanks to slashed sticker prices, not lower interest rates. That's because auto loans are not overly rate sensitive. For example, despite the Fed rate cuts, the average five-year note for a new car loan is at 7.05%, down from 7.60% a year ago.

"Rates have not gotten significantly lower, but even if they did it wouldn't have a significant impact on affordability," said McBride.

Plus, even if borrowers can get financing, the difference of a percentage point doesn't seriously impact affordability. "Nobody is upgrading to a Hummer based on lower interest rates," McBride added.

For many mortgage holders, the cumulative Fed rate cuts will result in lower payments when their variable-rate loans reset in 2009. But there is also a diluted effect: While this is a good time to refinance your existing mortgage, those in the market for a new home will need excellent credit to get a low rate.

"To obtain today's low interest rates, you need to have a down payment - or equity position in your home in the case of a refi - of at least 10% and fully document your income and your assets," said Keith Gumbinger, vice president of mortgage-rate tracking firm HSH Associates. "If you don't have good credit, you're going to have trouble getting financing."

"It used to be, you had to prove you were alive to get a mortgage," he added.

[ForexGen White Labels]

Forex White Label partnership allows the trader a quick access to the online foreign currency exchange market.

ForexGen provides two types of trading White Label partnerships, a limited and a full solution. ForexGen different types of forex White Label partners are able to access ForexGen's trading platform entirely branded under each partner's unique company image and name. We provide a customizable online trading platform for the different types of the two White Label solutions.

[Full White Label]

We provide 'full White Label partnership' to match the needs of the regulated companies and organizations that have a legal authorization to hold clients' funds. Our online trading platform is the most qualified online trading software in addition to an experience based infrastructure, but the full White Label partner is responsible for all administrative work and of all contact with their clients, i.e. opening of accounts.

[Limited White Label]

Limited White Label partners are also offered to access our customized online trading platform but their customers have to open a direct forex trading account with [ForexGen] Investments. Consequently, limited White Label partners could be not regulated by a financial authority as they will not hold customers' funds. This service permits the customer to manage his trading actions freely without vast administrative paperwork.

Posted by Broker.Forex at 6:46 PM 0 comments

Labels: Fed Rate Cut, ForexGen White Labels

Being Successful in The Forex Marketplace

Wednesday, December 17, 2008

Gaining the amount of knowledge needed to be successful in the Forex marketplace is actually not difficult. Someone with an education of an Associates Degree, or even a high school diploma would be able to gain the knowledge with just a few years of studying the market.

Gaining the amount of knowledge needed to be successful in the Forex marketplace is actually not difficult. Someone with an education of an Associates Degree, or even a high school diploma would be able to gain the knowledge with just a few years of studying the market.

However, no matter the amount of education or training you have, the number one problem new investors have is making good decisions. While some investors have no problem making decisions and sticking to them, the majority of the human race simply have trouble doing this. Whether it is emotion, lack of knowledge, or uncertainty that makes decision making hard, it must be overcome to be successful in the Forex market.

Your main tool again potential risk is knowledge. Learning as much as you can before your first trade will help you make informed decisions later. Simple knowledge can be obtained by studying articles and books, talking to a trained or experienced investor, or using a simulation program which allows you to trade within the market, without spending any actual money.

If you are waiting to success in the Forex market, you must learn to use technical indicators. These technical indicators will allow the trader to recognize long-term, short-term, and intermediate treads, which will allow the investor to construct his trades and portfolio to reflect the highest possible profits. It may take years for a new investor to fully understand the ups and downs of the market, and how to more accurately predict future trends.

[Why ForexGen]

1. Lowest spreads in the market with 0-1 pips in 10 pairs, no commissions, no swaps and instant account Activation.

2. Scandinavian quality with Swiss precision, funds secured and local agents in 18+ countries.

3. ForexGen offers Forex trading in the major currency pairs and crosses.

4. Low capital start, with $250 as a minimum account size.

5. Liquidity and 24/5 availability are the characteristic factors of the Forex market compared with other financial markets.

6. ForexGen offers a free trial Forex [demo account] that allows you to test your skills and practice without risking real money.

We consider every client as a special case, a VIP and a partner. A client's profit is our success and a client's loss is a significant call of action for us. Customer care is the heart of our business, we know every client on personal bases as we provide 24/7 customer support.

We keep contact with our clients to ensure that we are on the right track. Leading our client relationship to success is our focus.

Let [ForexGen] prove to you that you have taken the right step by choosing our partnership.

Posted by Broker.Forex at 6:22 PM 0 comments

Labels: forex market, forexgen

Consumer Prices And Housing Fan New Economic Fears

Tuesday, December 16, 2008

Consumer prices plummeted again at a record pace and groundbreaking on new homes slumped to a new low in November as the recession-hit economy lost momentum, government reports on Tuesday showed.

The latest signs of economic distress came hours before Federal Reserve policy-makers were expected to announce another reduction in official interest rates, and the data kept alive speculation they could cut by even more than half percentage point to ward off deflation risks.

"I think we're in a deflationary spiral that will probably go on until sometime next year," said Thomas di Galoma, head of U.S. Treasury trading at Jefferies & Co. in New York. "I think it will probably go on through the majority of 2009."

The Labor Department said its closely watched Consumer Price Index dropped 1.7 percent after falling 1 percent in October -- back-to-back record drops since the department started keeping monthly data in 1947. Core prices, which exclude food and energy items, were flat in November after declining 0.1 percent in October.

On a year-over-year basis, core prices were up 2 percent in November, a level that normally would please U.S. central bank policy-makers, but prices still appear to be headed down.

The Commerce Department said housing starts dropped 18.9 percent to an annual rate of 625,000 units from 771,000 units in October, the lowest since the department started collecting monthly starts data in 1959, and well below the 740,000-unit pace that Wall Street analysts had expected.

"The housing starts data is another bad sign for the overall U.S. outlook," said Brian Dolan, chief currency strategist for Forex.com in Bedminster, New Jersey. "There's zero sign of any stabilization, dashing what had been some optimism that we were perhaps bottoming out."

Soaring foreclosures and a drop in home building already has helped produce the worst financial crisis in decades and tipped the economy into recession last December. Many economists think the downturn is worsening steeply as 2008 ends and any recovery will be delayed past mid-2009.

The prices report showed that, on a year-over-year basis, consumer prices gained just 1.1 percent after a 3.7 percent increase in October. It was the smallest rise since mid-2002.

The yield on 30-year U.S. Treasury bonds hit a record low after the price data was issued and the dollar weakened against other major currencies. But stock prices posted modest gains on the expectation of an interest-rate cut.

So far in 2008, overall consumer prices have risen at an annual rate of 0.7 percent, sharply lower than the 4.1 percent gain for all of 2007.

Energy prices plummeted 17 percent last month, double the 8.6 percent fall in October. It was the largest monthly decrease in energy prices since the department started monthly records in 1957.

Gasoline prices tumbled a record 29.5 percent on top of a 14.2 percent October drop and were 47 below the peak they hit in July. Natural gas prices fell for a fourth straight month, which may benefit consumers in the winter heating season.

But jobs still are disappearing at an accelerating pace and consumers are wary about spending amid reports that not only the U.S. but much of the global economy is in recession.

Food prices in November were up a relatively slight 0.2 percent after a 0.3 percent October rise. It was the smallest monthly gain in food costs since March.

The housing report also pointed to a protracted downturn for that hard-hit sector. New building permits, an indicator of builders' future plans, dropped 15.6 percent to 616,000 units from 730,000 units in October. That was also much below Wall Street analyst estimates of 700,000 and the lowest since records began in 1960.

[ForexGen Demo Accounts Contest]

Win Cash Prizes

[ForexGen] has the pleasure to announce the launching of the Demo Account contest on the first of every month.

Interested clients who wish to participate in this event shall send an e-mail request on demo.contest@forexgen.com including the following information:

- Full name:

- Phone number

Also provide us with the following identification document:

" Certified copy of the information pages of account holder current valid passport or government issued photo ID"

After we receive your request we will provide you with further details and with your [demo account] login information which will be used in the trading contest.

By the end of each contest:

1. All participants that manages to open at least 20 lots will be awarded a Live Account with $50 credit

2. All participants that manages to open at least 20 lots and keep their demo account initial balance will be awarded a Live Account with $100 credit

3. The highest 5 accounts with the highest profits (including the floating P/L) will be awarded a Live Account with $250 credit.

The contest starts on the first Sunday of each month at 10 pm GMT and ends on the last Friday of that month at 10 pm GMT.

For more information about our current and future promotions, kindly contact one of our customers support agents at promotions@forexgen.com

Posted by Broker.Forex at 2:58 PM 0 comments

Labels: ForexGen Demo Accounts Contest, Housing

Research and Markets

Monday, December 15, 2008

Seagate Technology and the U.S. Computer Storage Device Manufacturing Industry - Out Now The Seagate Technology company report details the company's key financial data, business operations, technology and patent activities, financial benchmarks against the Computer Storage Device Manufacturing industry in the US, and that industry's pertinent information such as financial data, downstream industries, competitive landscape, upstream industries, and industry structure.

The Seagate Technology company report details the company's key financial data, business operations, technology and patent activities, financial benchmarks against the Computer Storage Device Manufacturing industry in the US, and that industry's pertinent information such as financial data, downstream industries, competitive landscape, upstream industries, and industry structure.

This company report provides a breadth of information on the company and its relevant industry in the US - Computer Storage Device Manufacturing industry, represented by the 6-digit NAICS code 334112. The report first presents the company data, and then presents industry data in a similar, logical flow for the reader to draw relevant comparisons. The complete understanding of the company and its industry allow for better forecasting of specific and industry-wide trends in times of economic uncertainty. This detailed information resource contains at least 5 years of independently researched industry statistics cross-referenced with the relevant U.S. and international economic indicators. All data have been verified to ensure the highest quality.

[ForexGen Introducing Brokers] Introducing Brokers may be individuals or institutions who gain their income from the commissions and/or rebates by introducing customers to ForexGen trading.

Introducing Brokers may be individuals or institutions who gain their income from the commissions and/or rebates by introducing customers to ForexGen trading.

WHAT are the advantages of being an INTRODUCING BROKERS with ForexGen?

* Providing the most huge income sharing plan

* Providing several ways for our IB's to charge commission.

* ForexGen IB can also charge commission for each lot the traders execute.

* Moreover, ForexGen IB is able to increase the spread for all or certain clients and have ForexGen Investments rebate the difference.

In case the IB does not increase the spread or charge their clients a commission, ForexGen rebate the IB a minor predefined amount for every client's executed lot.

Commission is paid out every month.

Individualized service

[ForexGen] offers our IB's individualized service created according to the individual needs and specified business situation for each IB.

Our Introducing Broker program provides a highly organized program for individualized services and organizations in order to introduce their clients to the online foreign currency exchange market, moreover they will enjoy the benefits of being a part of the ForexGen family.

ForexGen offers 1 pip spread on 10 pairs with high trading techniques that make ForexGen

incomparable to any other rival.

Posted by Broker.Forex at 2:16 PM 0 comments

White House Assessing Options to Aid Carmakers

Sunday, December 14, 2008

White House assessing options for emergency help for struggling auto industry amid obstacles

The White House weighed its options Saturday for preventing a collapse of the troubled auto industry, once the backbone of the U.S. economy. So far, the only thing certain is that the Bush administration wants to avoid the possibility of a disorderly bankruptcy of any of the Big Three.

General Motors Corp. and Chrysler LLC have said they could run out of cash within weeks without government help.

"Administration officials are continuing to gather financial information from the automakers, assessing the data, their cash position going forward," White House deputy press secretary Tony Fratto said Saturday. "We'll take a look at that information, make some judgments and review our options."

Any avenue of government rescue must surmount political obstacles and take into account the potential fallout on financial markets in a time of recession. The administration is keeping President-elect Barack Obama and his advisers abreast of its discussions.

"We'll be focused on trying to get the policy right while considering the best interests of the taxpayer and our economy, and we'll take the time we have available to do that right," Fratto said. "No decisions have been made."

The White House and congressional Democrats had agreed on a $14 billion measure that would have extended short-term financing to the industry and set up a "car czar" to make sure the money was used to turn the Big Three into competitive companies. The legislation, however, died when Senate Republicans demanded upfront pay and benefit concessions from the United Auto Workers that union officials rejected.

The failure on Capitol Hill prompted urgent requests for White House intervention. Administration officials were dispatched to weigh the pros and cons of a range of other bailout actions. White House and Treasury Department officials are keeping details of their discussions closely held for fear of affecting markets, but financial experts have zeroed in on a few likely avenues for helping the auto industry and its 3 million workers.

One way is to tap directly into the $700 billion financial rescue bailout fund to provide loans to the carmakers. Another is to use part of the bailout fund as a kind of collateral for emergency loans the automakers could get from the Federal Reserve. The administration also could do nothing, leaving open the possibility that one or more of the automakers could go bankrupt. It also could wait for the new Congress, flush with more Democratic votes when it returns in early January, to try again to get bailout legislation passed.

"In terms of what happens next, it seems like the real question is `How long can GM really hold out?'" said James Gattuso, a research fellow in regulatory policy at the Heritage Foundation. "I've heard a couple of weeks and I've heard through February. I think only the people on the inside of GM know that."

For weeks, the White House has insisted that the $700 billion financial industry rescue plan enacted in October should be used solely to help financial institutions. On Friday, however, the White House signaled that it would consider using the so-called TARP -- Troubled Assets Recovery Program -- to prevent auto manufacturers from collapsing.

Critics quickly pointed out the administration's U-turn. They insisted the White House reject calls to do an end-run around Congress and unilaterally use TARP money to help the carmakers. "You're dealing with a significant amount of money and sums of this sort just simply can't be repurposed just because it's there," Gattuso said.

A second possibility offers Bush some political cover. Treasury Secretary Henry Paulson could use part, but not all, of the $15 billion left of the first $350 billion allocated to the TARP to back up loans the automakers could get from the Fed's emergency lending program. That would leave some money to help troubled financial institutions, which Bush has long argued should be the first in line for TARP money.

Federal Reserve Chairman Ben Bernanke has said he's reluctant to use the Fed's emergency lending program for the automakers. Decisions about giving financial aid to Detroit are best left to Congress, he says.

Bernanke also has questioned whether the automakers have sufficient collateral to secure emergency loans from the Fed. And critics worry that other companies might take risks knowing the central bank could help bail them out too.

However, financial analysts who think this avenue for helping the automakers is viable note that in March, faced with the collapse of Bear Stearns, other investment houses were allowed to draw emergency cash loans from the Fed. That marked the broadest expansion of the Fed's lending powers since the 1930s.

If, for example, the Federal Reserve agrees to lend the automakers $15 billion, the Treasury could deposit maybe $5 billion with the Fed to be used first if any of the automakers defaulted, said Vincent Reinhart, director of the Federal Reserve Board's division of monetary affairs from 2001 to 2007. "From the Fed's standpoint, it makes them feel more comfortable, and politically, Bush hasn't used all the resources in the TARP," he said.

Asked whether GM thinks using the TARP money for direct loans or as collateral on loans from the Fed would provide the automaker with enough help in the short-term to avoid a collapse, GM Spokesman Greg Martin on Saturday replied "Yes."

The company's financial staff worked over the weekend exploring options with Treasury officials.

GM announced Friday it would cut an additional 250,000 vehicles from its first-quarter production schedule -- a third of its normal output -- by temporarily closing 20 factories across North America. The move affects most plants in the U.S., Canada and Mexico.

"If the administration can convince itself that a bankruptcy could be an orderly proceeding, then they could let it happen," Reinhart said.

The Bush administration, which has just weeks left in office, wants to try to avoid a disorderly bankruptcy.

"It's possible that the administration won't do anything," Reinhart said, listing long-running problems with the industry. "If the administration can convince itself that a bankruptcy could be an orderly proceeding, then they could let it happen."

[ForexGen Promotions]

*[Claim Your Bonus]

* [Live Account Contest]

*[ Demo Account Contest]

* [Refer A Client]

* [Scalping enabled Account]

Posted by Broker.Forex at 4:24 PM 0 comments

Labels: ForexGen promotions, White House

ForexGen | Wealth From Forex Trading

Monday, December 1, 2008

Forex (or foreign exchange) trading is rapidly growing in importance for traders. Forex offers the opportunity to build enormous wealth with a small initial capital outlay (and many people have found it to be their path to financial independence), but there are risks like any other investment choice. How can the beginner get started in forex and become successful?

Forex (or foreign exchange) trading is rapidly growing in importance for traders. Forex offers the opportunity to build enormous wealth with a small initial capital outlay (and many people have found it to be their path to financial independence), but there are risks like any other investment choice. How can the beginner get started in forex and become successful?

Becoming a Successful Trader

If you wanted to be a good motor mechanic, you would just get a spanner and start pulling your car apart, would you? Of course not. But many people start their forex trading by randomly making trades without getting the right tools and knowledge first, then wonder why they fail.

Firstly, you need to spend some time watching the markets without trading. Then forex offer to get a demo account from an online forex broker and start paper trading. This will give you a feel of the market without pressure from losses. You will see how the market moves, and understand the basics of trading forex.

Once you become familiar with the market, forex offer a trading system that works for you. In the same way that a motor mechanic has a systematic approach to his work, a trading system ensures that you can approach the market confidently. Forex offer trading system will tell you these things:

•When to enter the market

•Whether to buy or sell (depending on whether the market is going up or down)

•How much capital to allocate to the trade

•When to exit a profitable trade

•When to exit an unprofitable trade

Forex offer a Stock trading system that you are comfortable with. It needs to match your own risk tolerance and the time that you can set aside for trading. For example, if you are conservative and can only trade after work, you don't want a system that has huge ups and downs and needs constant 24 hour monitoring. One good way to ensure that you have a system that matches you is to build one yourself.

[Partnership With ForexGen]

ForexGen offers three types of business partnerships:

[ForexGen] provide appropriate services satisfying the needs of all business partner's specified situation and requirements.

Posted by Broker.Forex at 7:57 PM 0 comments

Labels: forex, Partnership With ForexGen

ForexGen | What Shoud I Be Looking For

Forex offers many support services for its traders, including Forex signal trading. Either Forex brokers or independent analysts monitor and analyze the market. Signal trading includes identifying trends. They identify these trends in the Forex market by using many varied and subtle indicators. Forex offers signal trading to help indicate to traders a good time to buy or sell, though these Forex brokers and analysts do charge a fee for their services. But having the option of using signal trading can make the difference between no profits and huge ones.

A lot of times in Forex signal trade they only monitor the most popular currencies. Forex offer pairs such as EUR/USD, USD/JPY, GBP/USD and USD/CHF. Though if you are interested you may find Forex signal services for the less common currencies and pairs. These however may charge a higher fee for their services.

There are some individual services included in Forex signal trading that forex offered generally . A lot of basic subscriptions to these services will email alerts for the best times to buy and sell. A little bit higher level of subscription though will alert you about these via cell phone or pager. Some levels of subscription for Forex signal trade will provide the subscriber with live charts, in order for the trader to make their own decisions if they so choose to do so. Usually the minimum subscription fee is one hundred dollars a month, with charges only going up from there.

Forex offer the reasons that people choose to use a signal trading service or not is because it saves them the trouble of having to analyze trends on their own. Once again, you shouldn't use these services on their own, without other indicators. You should also make sure you tread very carefully until you are sure you can trust the company you are working with sufficiently. In the meantime, use other indicators, trust yourself and listen to the grapevine. Whether using the Forex market or another one, using any signal trade company or the Forex signal trading company

in particular, in the end it is up to you how and when you decide to use them.

[ForexGen The Million Dollar Question]

How do you figure out whether to freakin’ use oscillators, or trend following indicators, or both? After all, we know they don't always work in tandem.

This is probably the most challenging part about technical analysis. And why I call it the million dollar question.

We will provide the million dollar answer in a future lesson.

For now, just know that once you're able to identify the type of market you are trading in, you will then know which indicators will give accurate signals, and which ones are worthless at that time.

This is no piece of cake. But it's a skill you will slowly improve upon as your experience grows.

Posted by Broker.Forex at 7:35 PM 0 comments

Labels: forex market, forex offer, forexgen

ForexGen | How A Forex Online Trading System Can Help

Forex offer you to participate directly in the trade in currencies from any part of the world. Today, the trade in foreign exchange is considered one of the largest businesses in the world, with an average daily turnover of $3.2 trillion worth of currency exchanging hands each day. This has led to the popularization of foreign exchange as a means of investment. In examining how Forex offer you to make money, it is important to examine some of the key benefits of Forex online trading.

Forex offer you to participate directly in the trade in currencies from any part of the world. Today, the trade in foreign exchange is considered one of the largest businesses in the world, with an average daily turnover of $3.2 trillion worth of currency exchanging hands each day. This has led to the popularization of foreign exchange as a means of investment. In examining how Forex offer you to make money, it is important to examine some of the key benefits of Forex online trading.

1-Online Forex Trading Benefit

For one, a Forex offers you unparalleled flexibility. Unlike the stock markets, foreign exchange markets are organized via advanced telecommunication devices and forex offer the trader to make trades 24 hours a day, five days a week.

forex offer you to be able to participate in trading activities from the comfort of your home even during leisure hours after you end a day of work at the office. Forex offer you to earn money without sacrificing your day job. In another words, if you are successful in Forex trading, you will earn a double paycheck.

2-Online Forex Trading Benefit

Moreover, most online trading system of forex offers you a full range of investment tools and resources needed to get you started. Simply by opening an online Forex trading account with a broker, you will be given full access to vital information such as analyst reports as well as workshops pertaining to Forex trading which you can attend.

Better still, in most cases you get access to a whole range of charting software allowing you to use technical analysis in guiding your next investment decision. Such technical capabilities are necessary in order to allow you to time your precise entry and exit into the markets. Such resources and tools are extremely important where Forex trading is concerned. Access to such trading software allows you the ability to start making money through your trades.

3-Online Forex Trading Benefit

In addition, most online trading systems of forex offer you a demo account with which you can use from time to time. These accounts make use of paper credits while allowing you to trade in real time in the Forex market. This is important as you would be able to practice whatever strategies you may have developed along the way before entering the Forex markets with real money.

Ultimately, the forex offered benefits by online trading system are aplenty. It is important however, for the investor to also improve on his or her financial knowledge and market analysis techniques in order to take full advantage of what a Forex online trading system has to offer. Forex offer you to reap greater financial rewards and allow you to achieve higher returns on your investment.

[ForexGen Academy]

If you are an experienced ‘FOREX’ Trader or just a beginner looking for the opportunities offered in the ‘FOREX’ market, [Forexgen] has created ForexGen Academy to give you the chance to get a ‘FOREX’ education and improve your trading skills. No hard expressions, no buzz words, and no rocket science language are used throughout these lessons.

How to Get Started?

People are introduced to the exciting world of foreign exchange in many ways: friends, current events, newspapers, television, and many others. For those of you who are new to forex, the following guidelines cover the basics of currency trading.

Posted by Broker.Forex at 7:20 PM 0 comments

Labels: forex offer, forex trading, ForexGen Academy